Schedule XIII to the Companies Act,1956 Section 198 Overall maximum managerial remuneration. Managerial remuneration in case of absence or inadequacy of. - ppt download

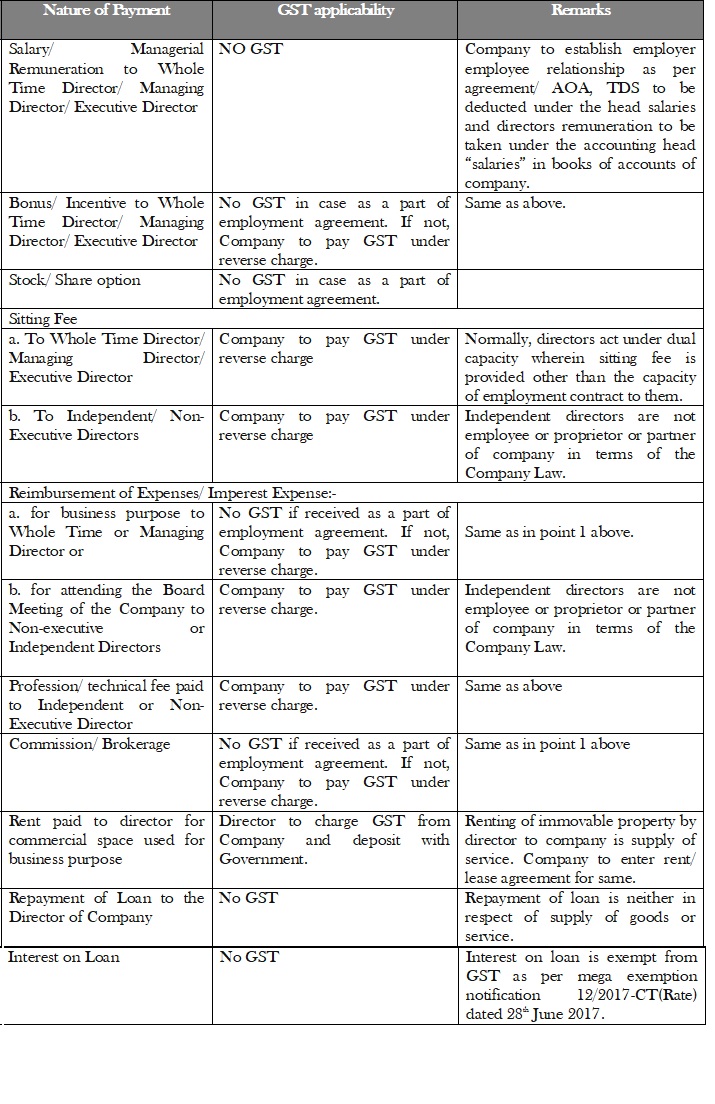

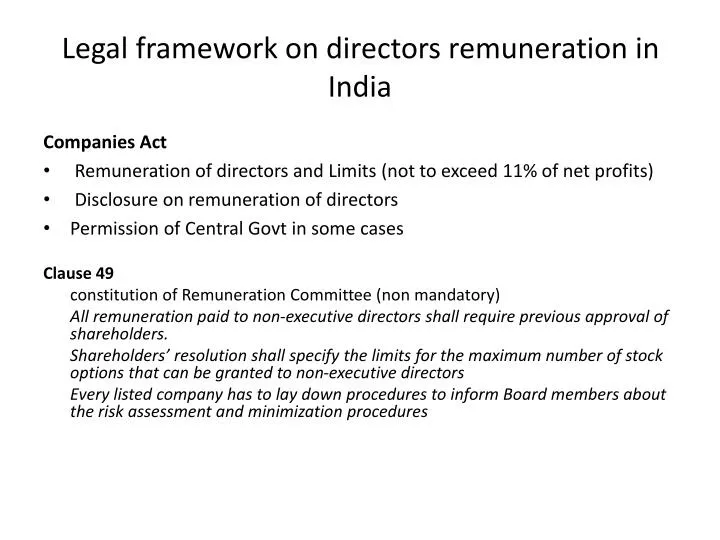

Remuneration to non-executive directors: Analysis of provisions under Companies Act and SEBI Listing Regulations | SCC Times

Directors Remuneration cannot be held as excessive for disallowance u/s 40A(2)(b) in absence of material brought on record

Remuneration paid to Whole Time Directors of Public unlisted Companies - Series 1 by Affluence Advisory - Issuu

INTRODUCTION Section 197 & Chapter XIII of the Companies Act,2013 deals According to section 197 of the Companies Act 2013 total remuneration to be. - ppt download