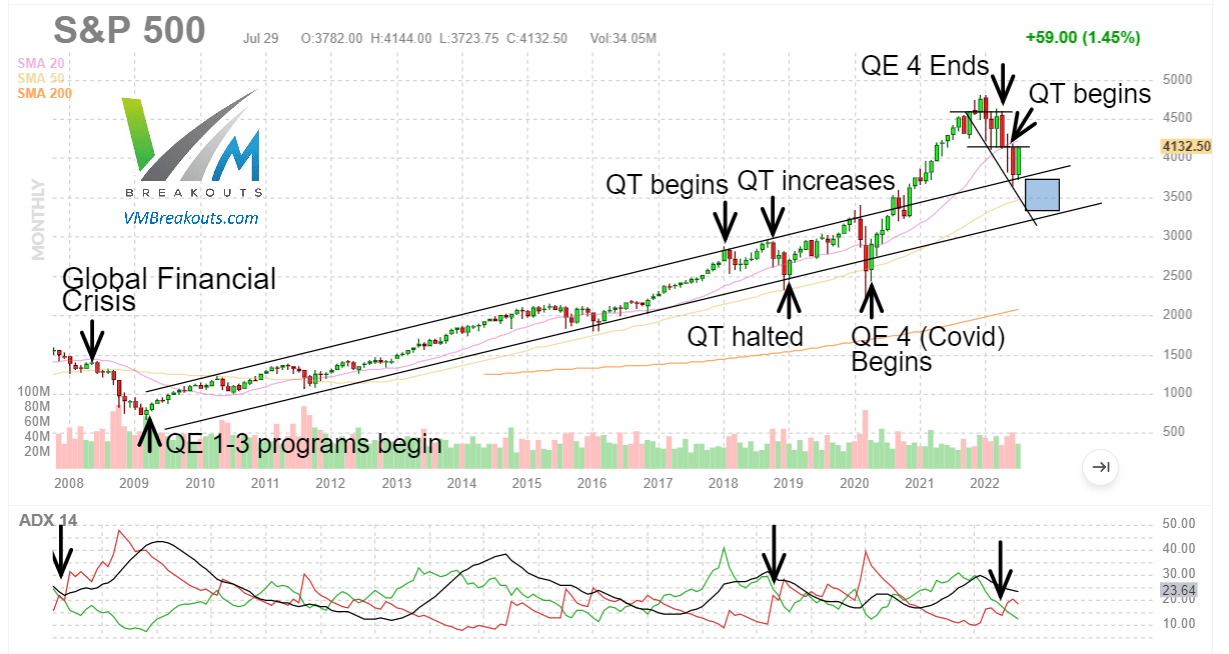

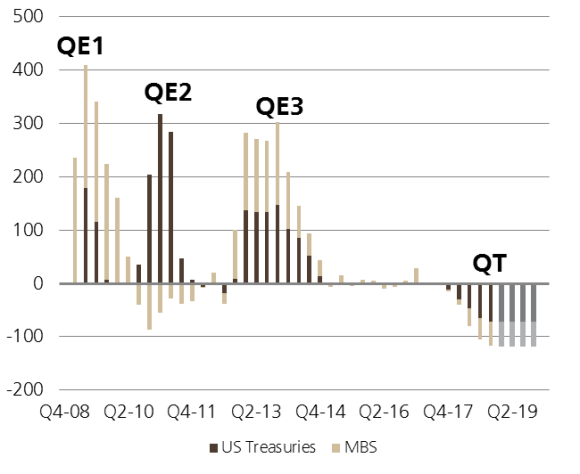

Fed's QT: Total Assets Drop by $91 Billion from Peak (QE created money, QT Destroys Money) | Wolf Street

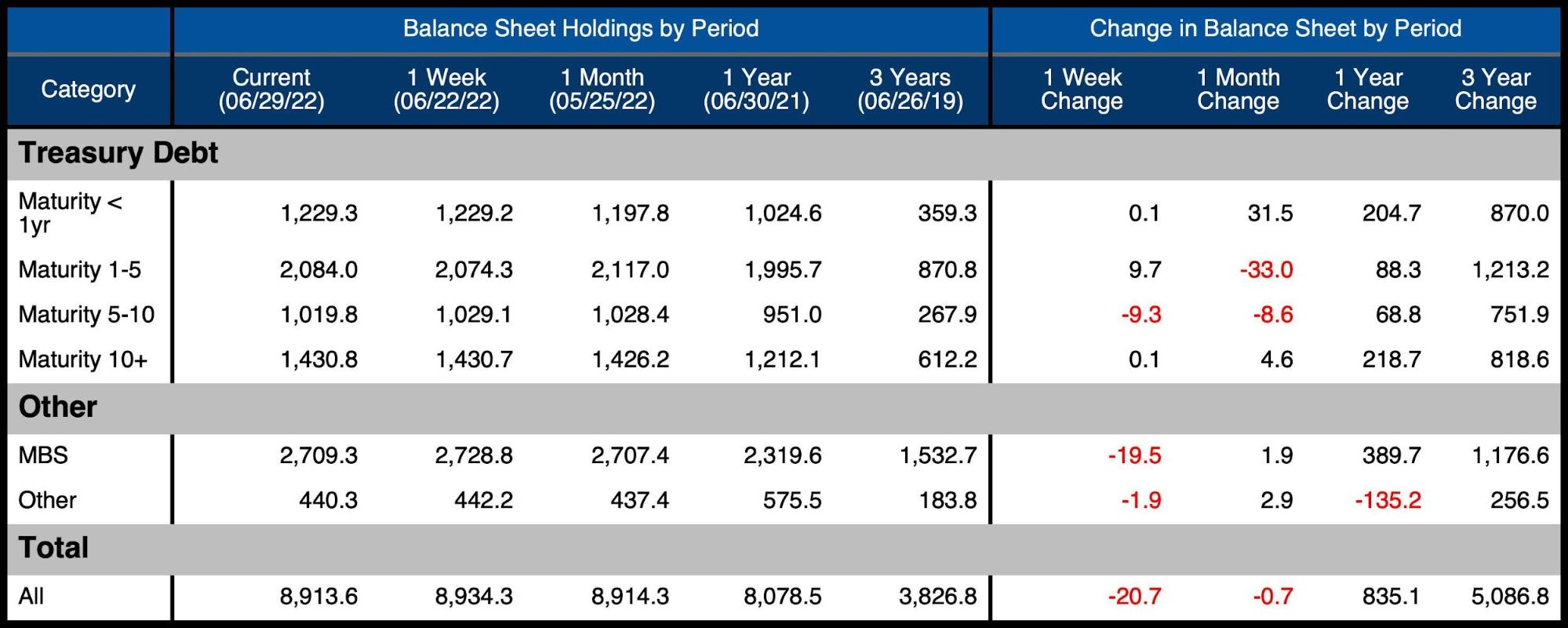

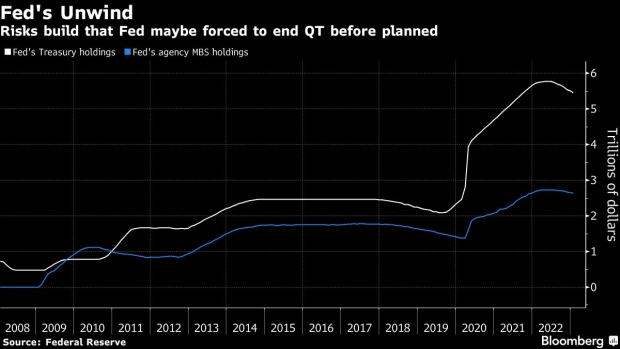

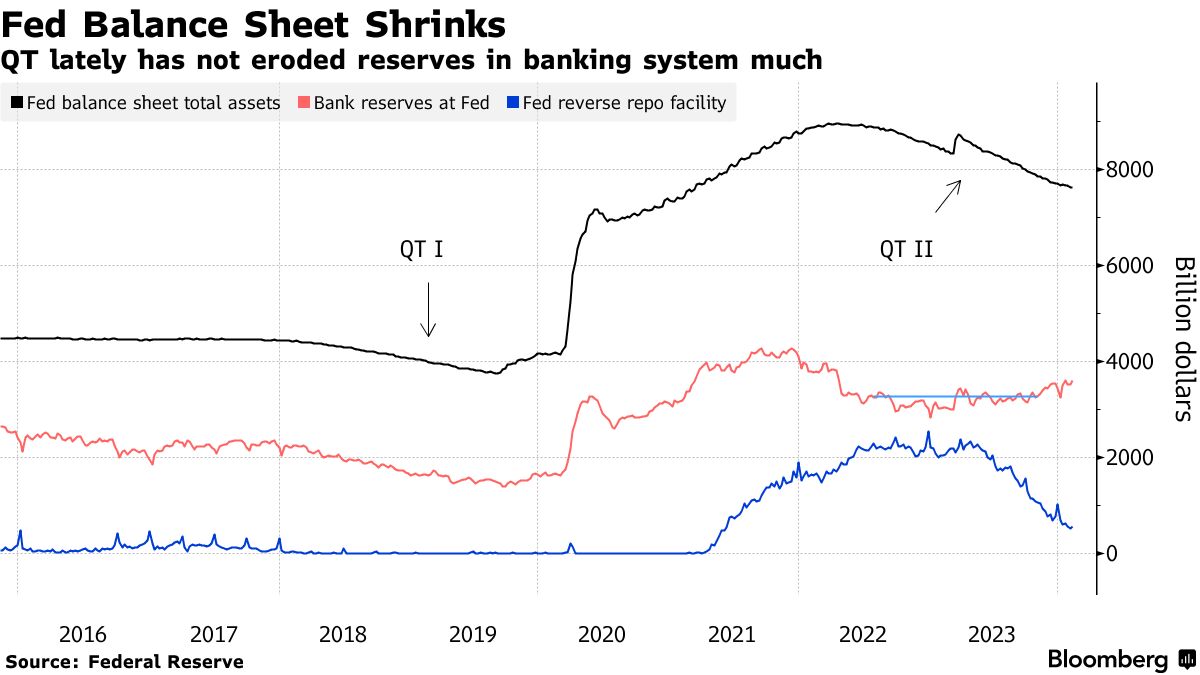

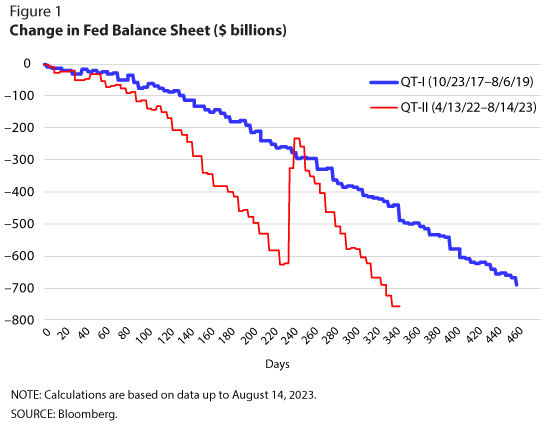

Fed Balance Sheet QT: -$1.1 Trillion from Peak, to $7.87 Trillion, Lowest since May 2021. | Wolf Street

Fed Balance Sheet QT: -$1.1 Trillion from Peak, to $7.87 Trillion, Lowest since May 2021. | Wolf Street

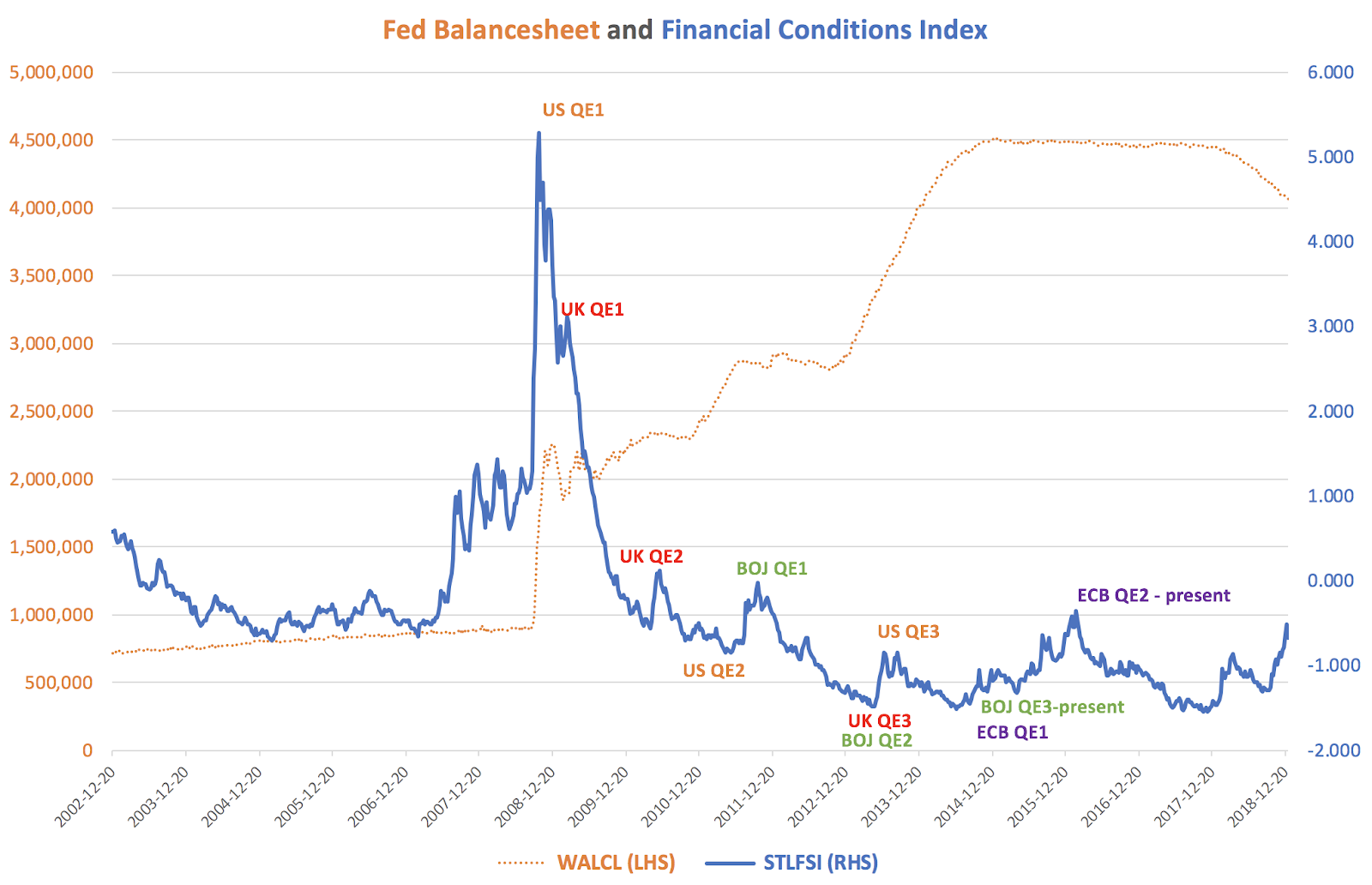

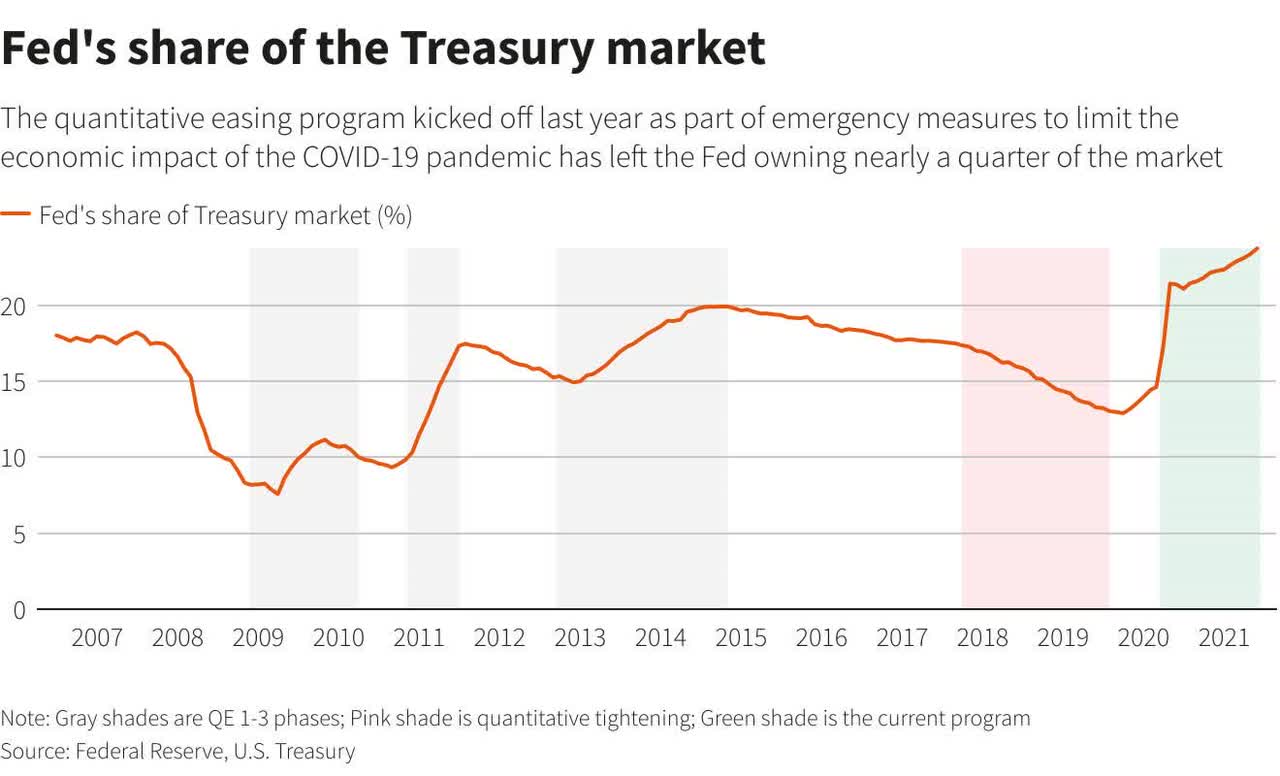

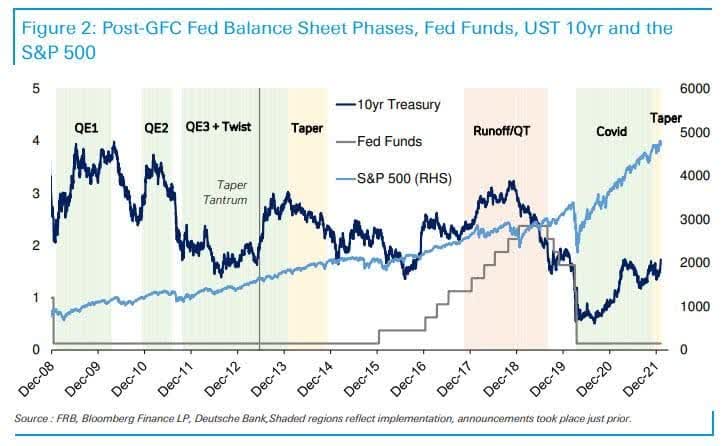

Jurrien Timmer on X: "With the Fed presumably finished hiking, a big question remains: What will happen to its balance sheet? Money market funds are depleting the Fed's reverse repo (RRP) facility

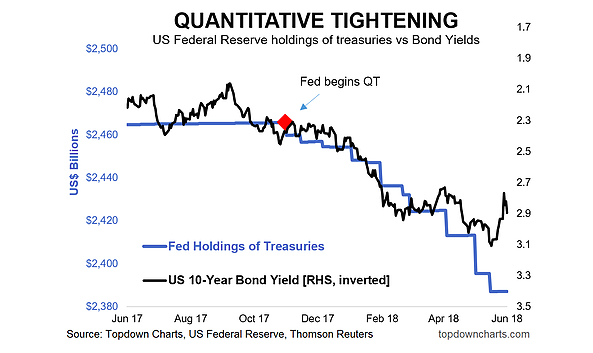

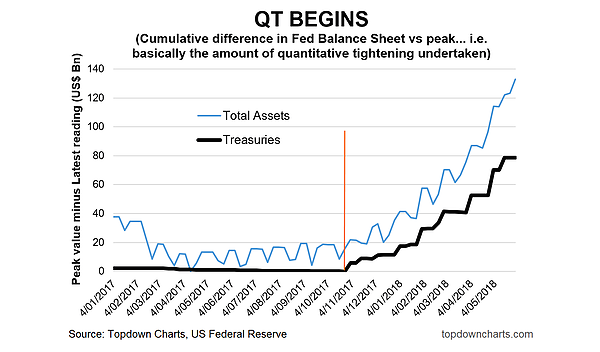

Fed's QT: Total Assets Drop by $91 Billion from Peak (QE created money, QT Destroys Money) | Wolf Street

Alf on X: "To me, there is a more important story going on: liquidity & funding are becoming tougher for small banks QT is reducing the balance sheet of the Fed On