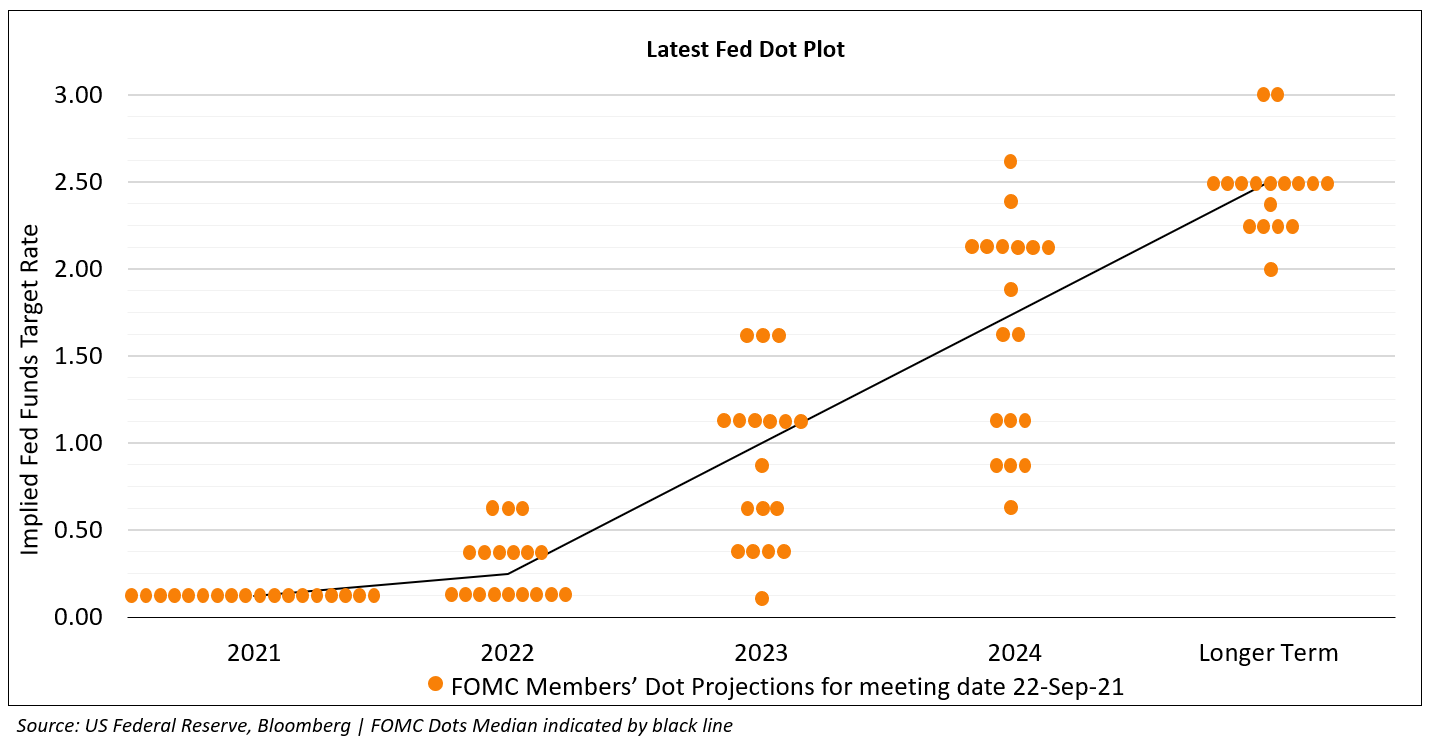

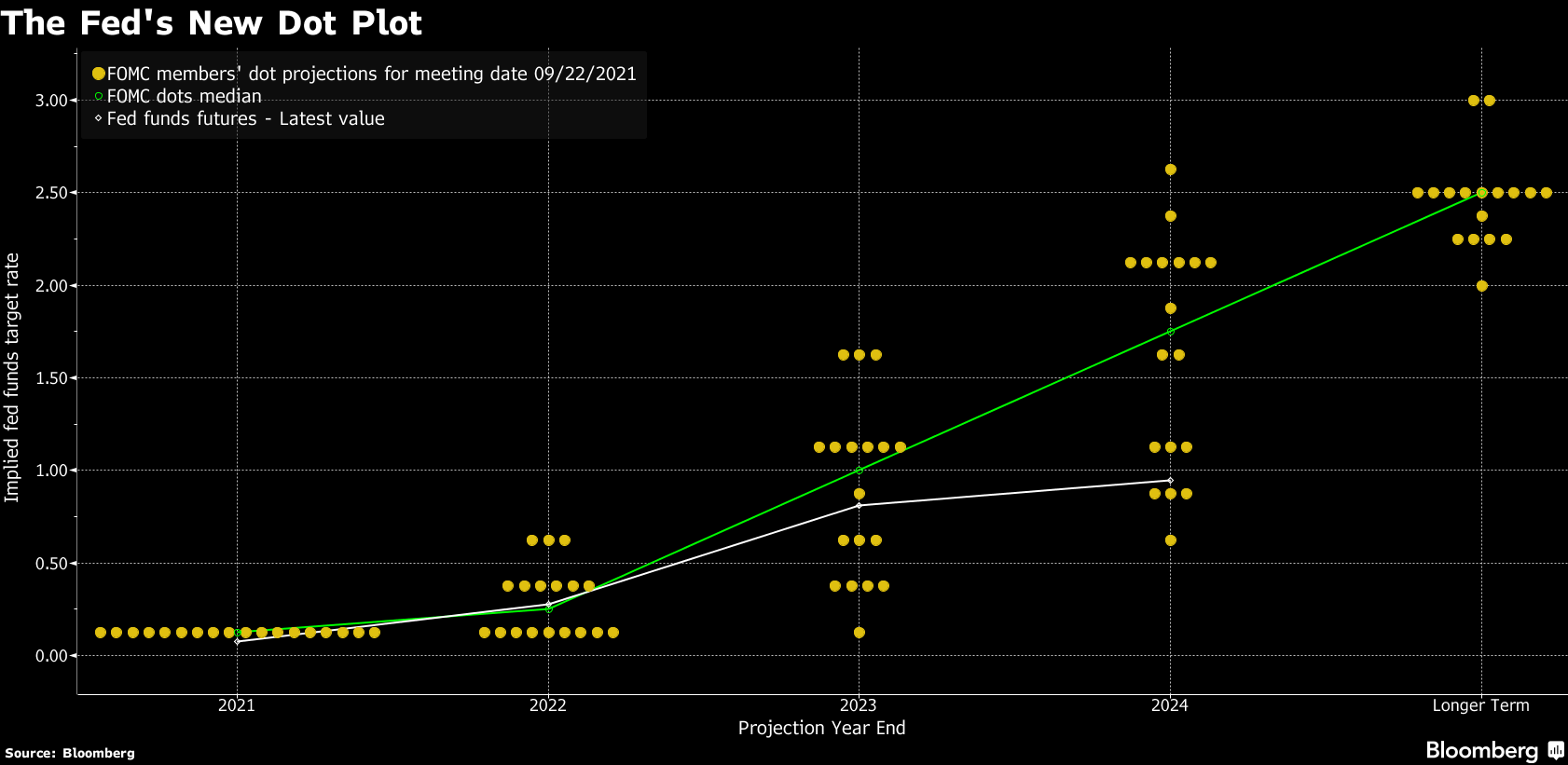

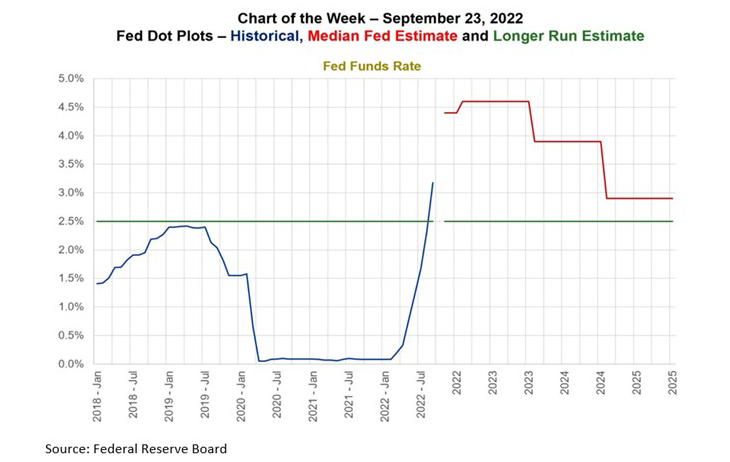

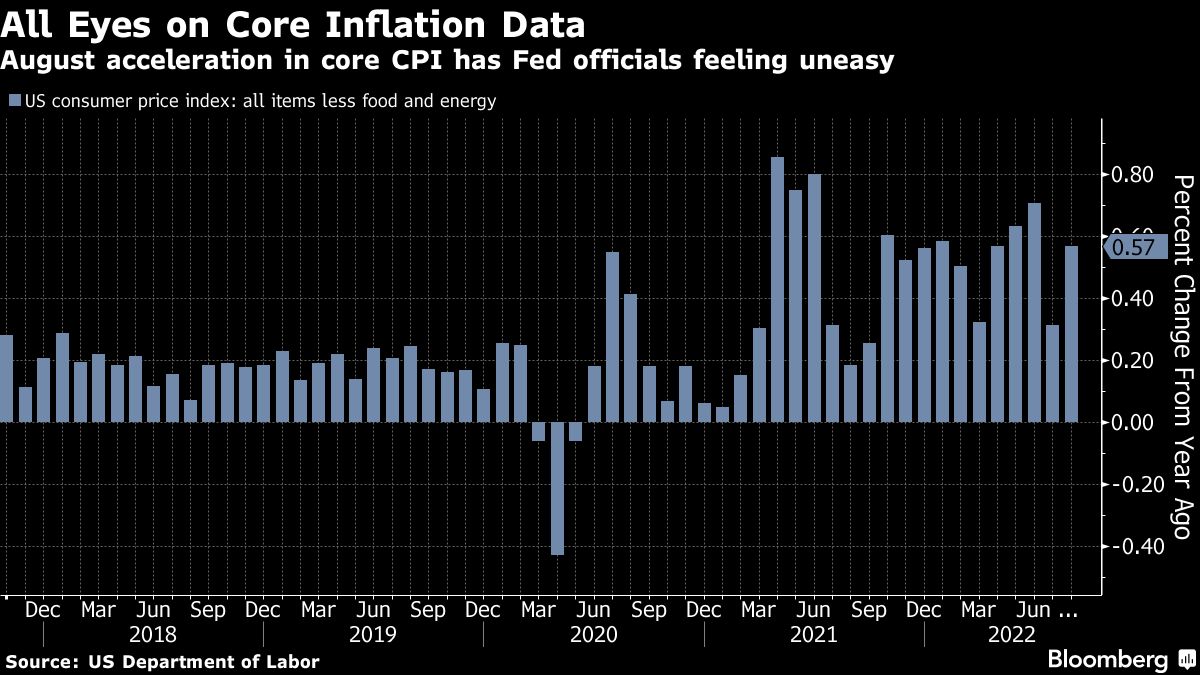

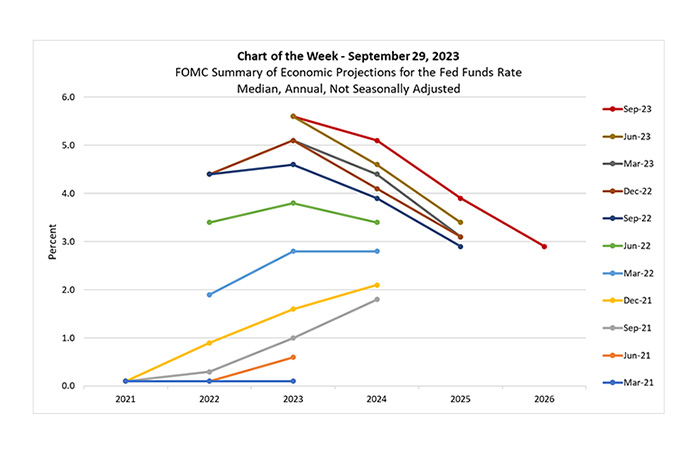

Rate Decision as Expected; SEP Shows Fed Raising Rates Higher for Longer amid Persistent Inflation and

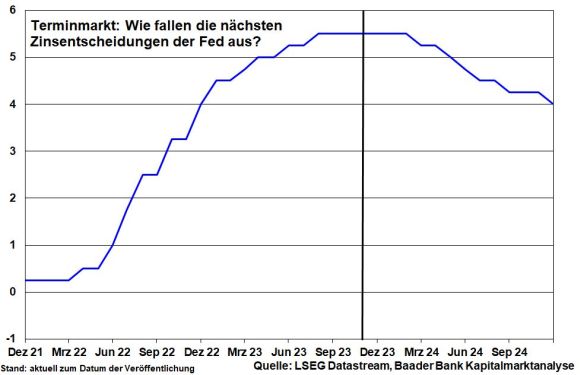

Holger Zschaepitz on X: "#Fed more hawkish than anticipated: Holds benchmark rate in 5.25-5.5% target range. 12 Officials see one more hike this year, 7 see on hold. Fed '23 median rate