Fed Balance Sheet QT: -$1.23 Trillion from Peak, -$129 billion in November, to $7.74 Trillion, Lowest since April 2021 | Wolf Street

Fed Balance Sheet QT: -$1.0 Trillion from Peak, to $7.96 Trillion, Lowest since June 2021. In September Alone -$146 billion | Wolf Street

Holger Zschaepitz on X: "Banking crisis in one chart. Fed balance sheet jumped by $297bn, largest weekly increase since pandemic. Financial institutions took billions in short-term loans from #Fed as the industry

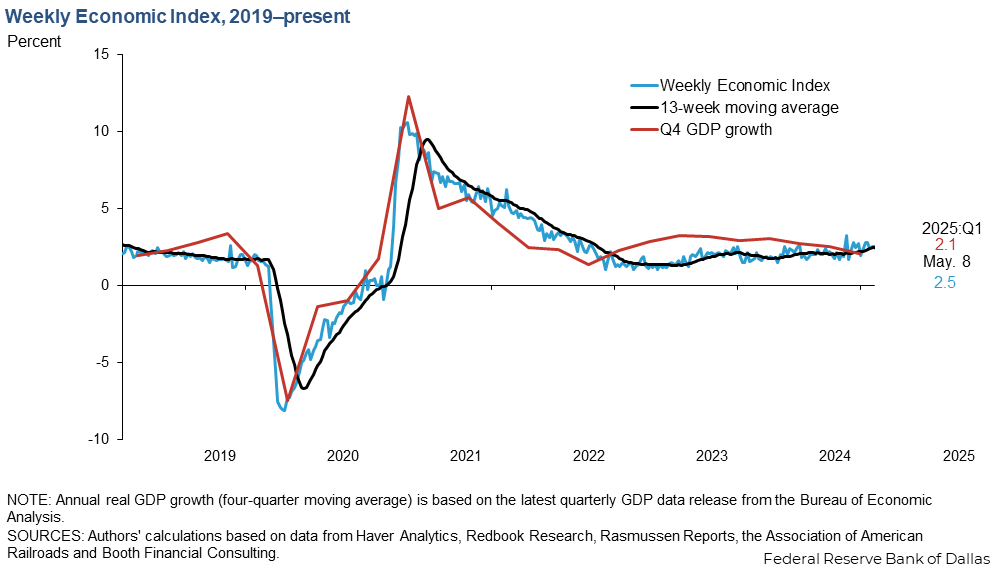

Carlsquare weekly market letter: Why doesn't the Fed stop their rate hikes to give the economy some much wanted breathing room? - Carlsquare Corporate Finance

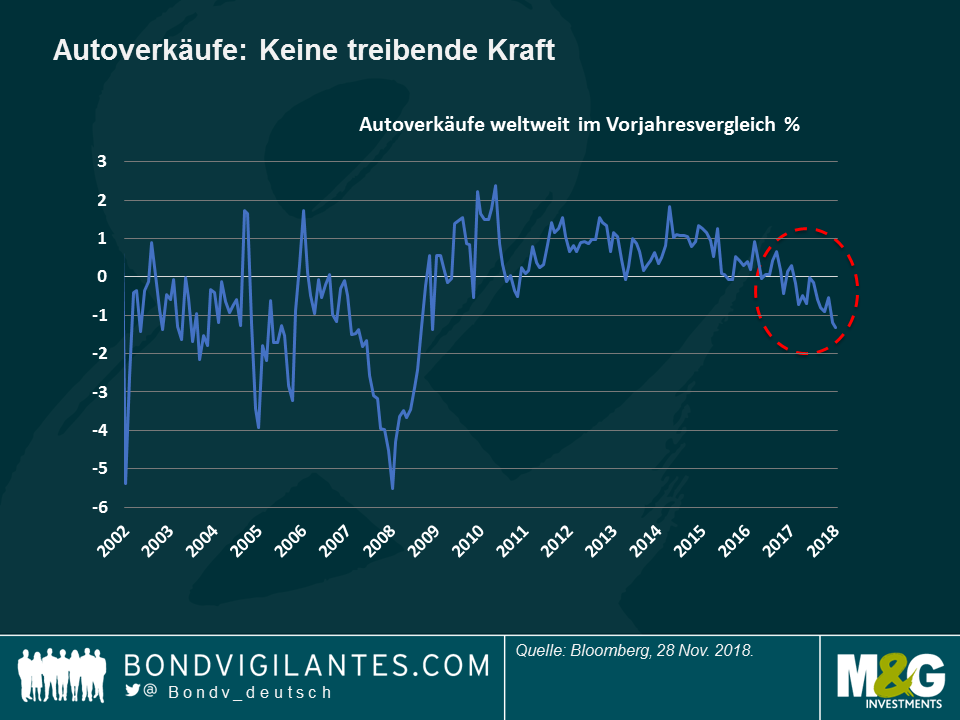

Fokusthema in dieser Woche: Die US-Notenbank Fed hat die Leitzinsen um 75 Basispunkte angehoben. | Amundi Asset Management | Berater

🗞 Fed-Zinsentscheid – Kommt die Überraschung? | KI als Hoffnung für Wachstum? | Der neue Bullenmarkt ist da! | stock3

Bitcoin Hits Yearly High as Spot ETF Expectations Continue to Build, Fed Governors Talk Interest Rates Ahead of December Meeting, and FTX Set to Sell Off Trust Assets | Gemini

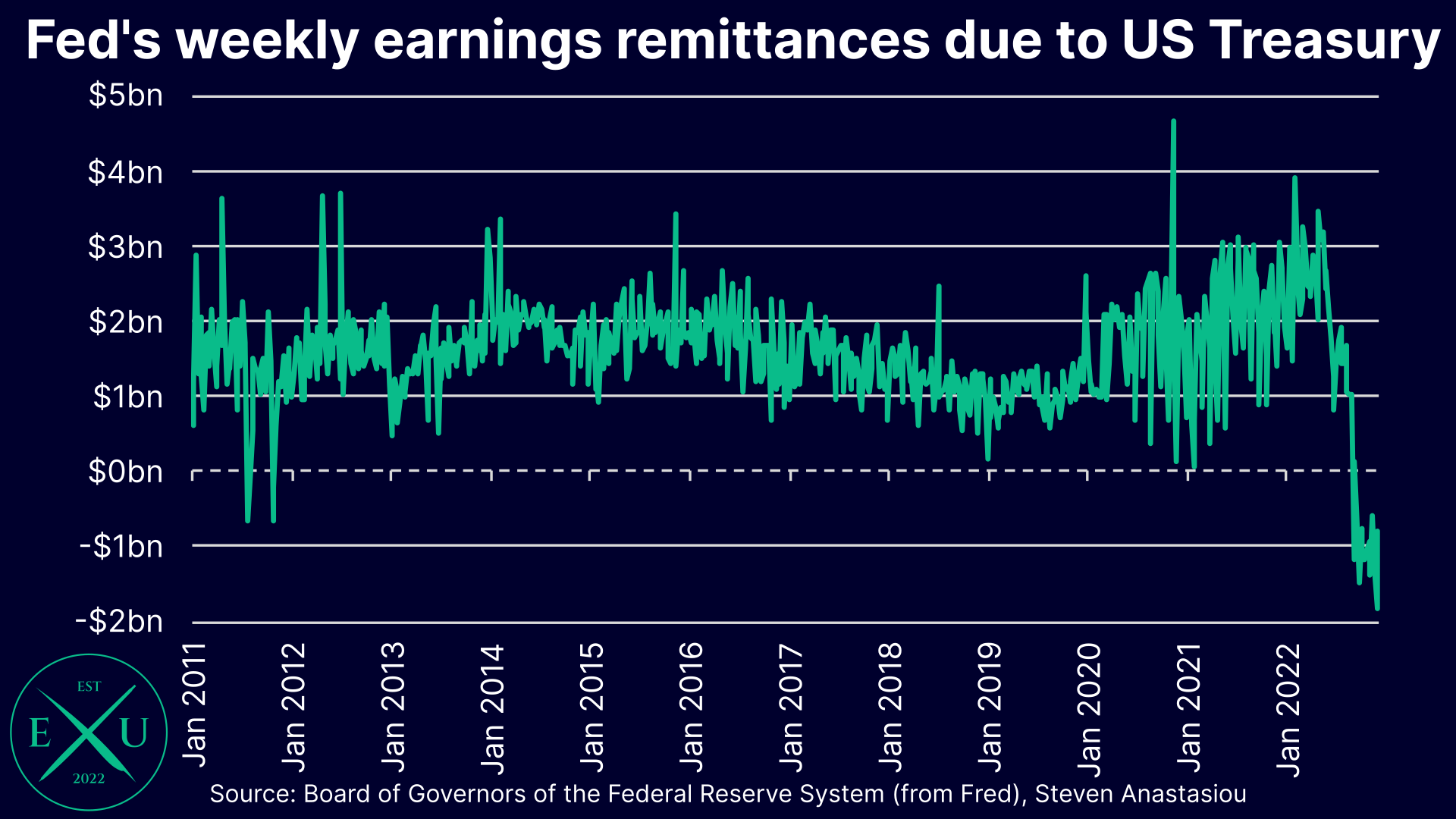

Fed's Cumulative Operating Losses Exceed $100 Billion. Rate of Weekly Losses Begins to Slow as QT Drains RRPs and Reserves | Wolf Street

BITCOIN: Liefert die FED das Benzin für die Attacke auf die $50.000 Marke? 🔴 Die aktuelle Bitcoin-Analyse 🔴 Chartanalyse, Wochenausblick und Trading Setups | XTB