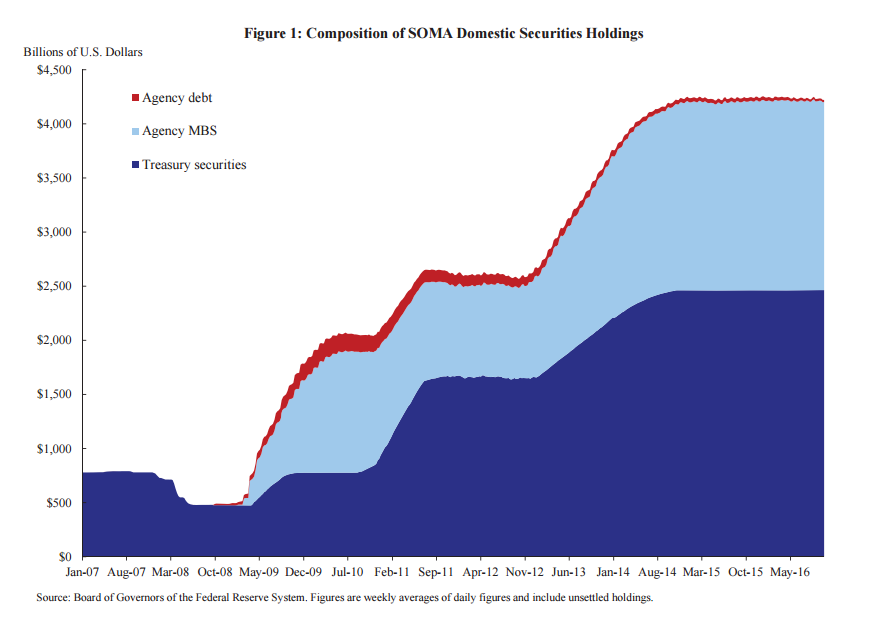

FRB: Finance and Economics Discussion Series: Screen Reader Version - FLOW AND STOCK EFFECTS OF LARGE-SCALE TREASURY PURCHASES: EVIDENCE ON THE IMPORTANCE OF LOCAL SUPPLY

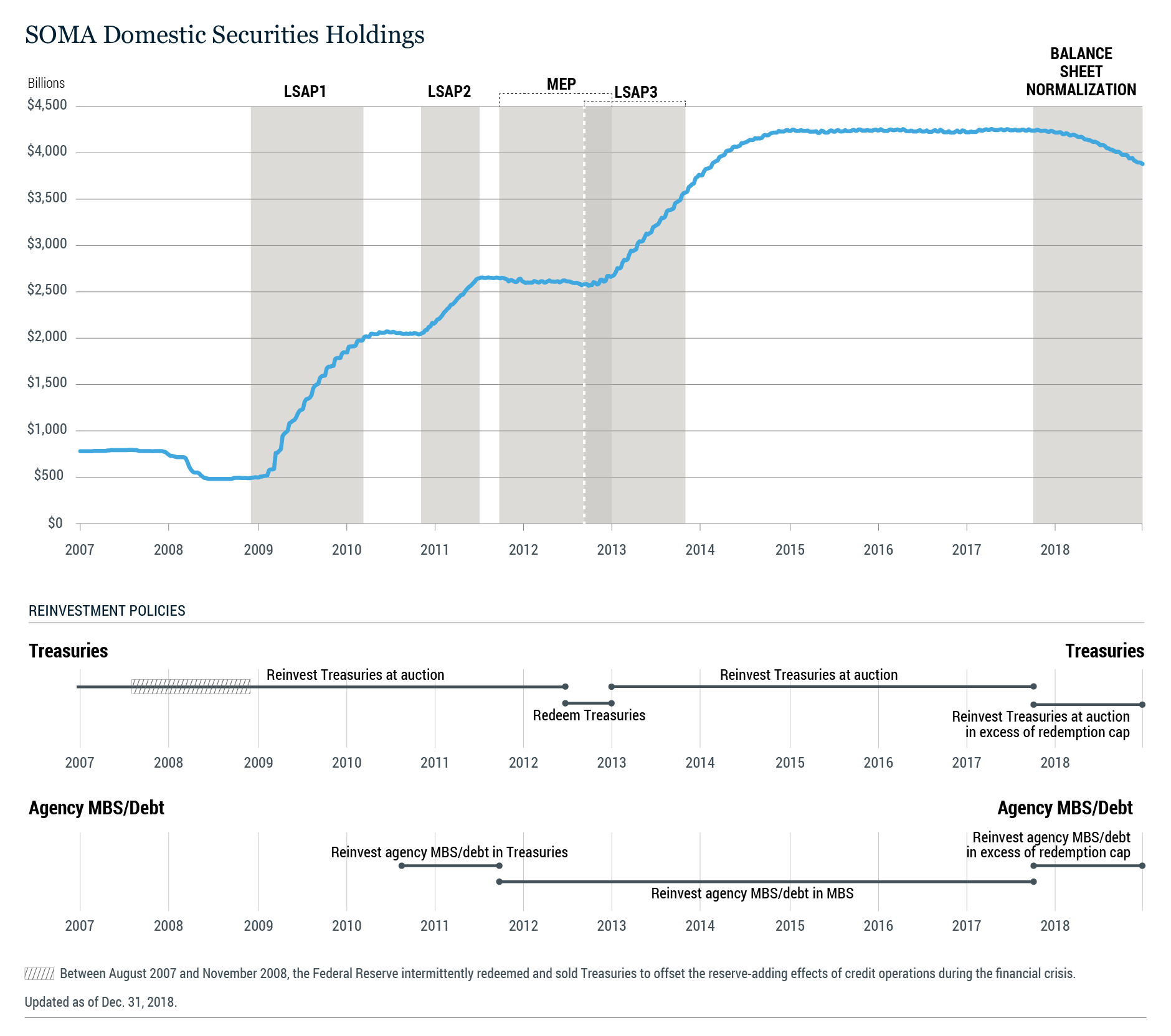

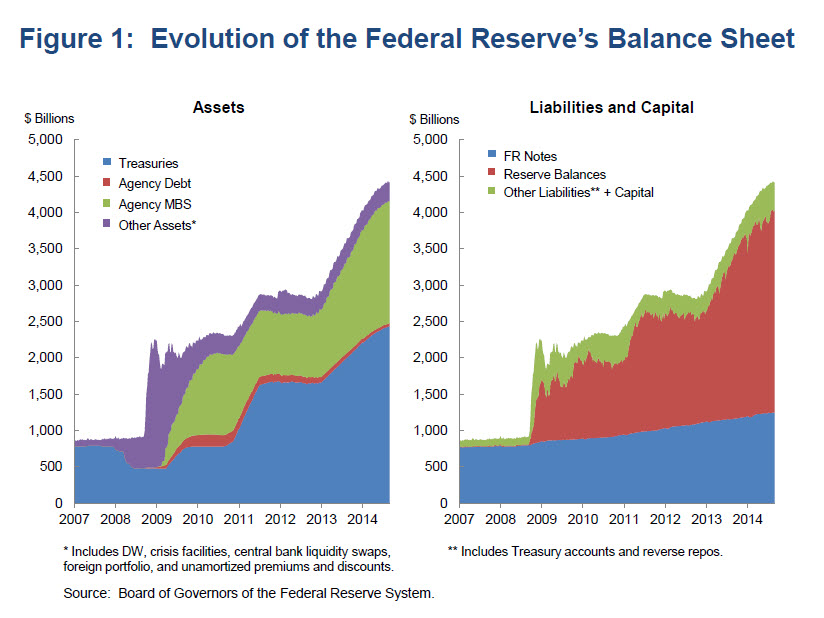

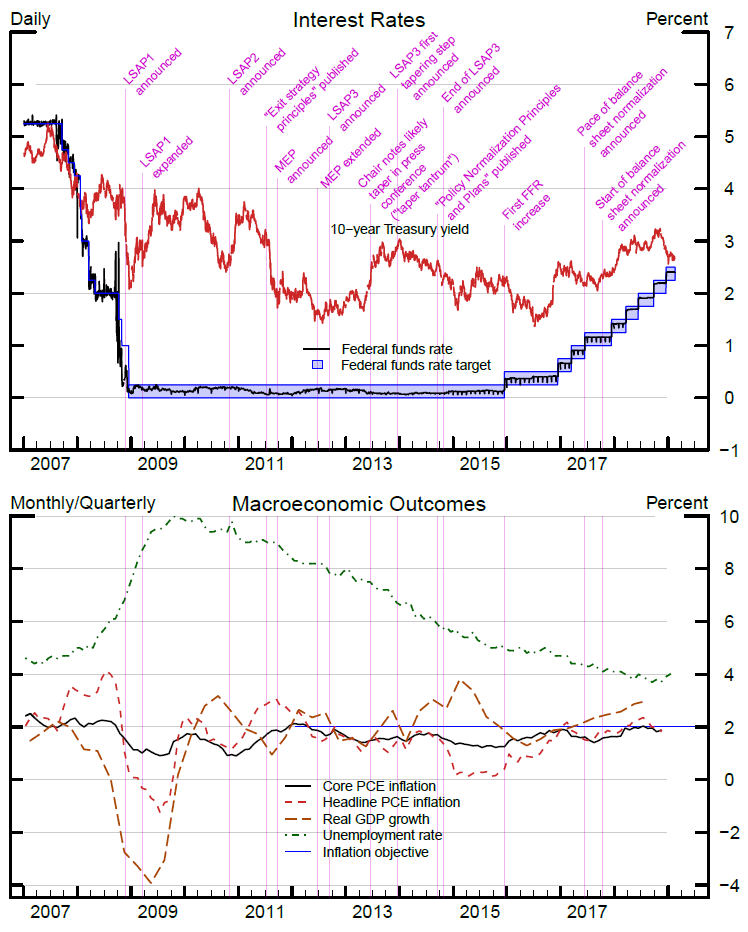

Unconventional monetary policy through the Fed's rear-view mirror — Money, Banking and Financial Markets

Fed Balance Sheet QT: -$1.28 Trillion from Peak, to $7.66 Trillion, Lowest since March 2021. Banks Got an Arbitrage Opportunity when Yields Dropped | Wolf Street

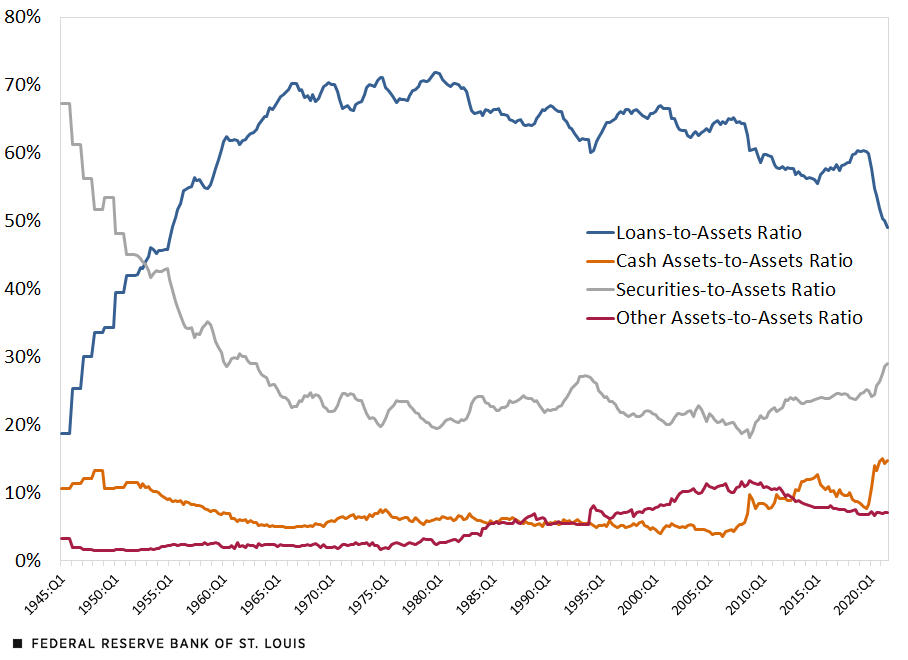

Fed Balance Sheet QT: -$1.28 Trillion from Peak, to $7.66 Trillion, Lowest since March 2021. Banks Got an Arbitrage Opportunity when Yields Dropped | Wolf Street

Central bank announcements of asset purchases and the impact on global financial and commodity markets - ScienceDirect

Fed Balance Sheet QT: -$1.28 Trillion from Peak, to $7.66 Trillion, Lowest since March 2021. Banks Got an Arbitrage Opportunity when Yields Dropped | Wolf Street